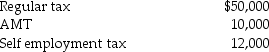

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Definitions:

Data Collection

The process of gathering and measuring information on variables of interest in a systematic fashion.

Random Assignment

A method used in experiments to assign subjects randomly to either the treatment or control group to eliminate bias.

Independent Variable

The factor in an experiment that is deliberately changed or manipulated to observe its effect on a dependent variable.

Equal Chance

A principle whereby each subject or experimental unit in a study has the same probability of being assigned to a particular group or condition.

Q25: Hilton,a single taxpayer in the 28% marginal

Q30: Intangible drilling and development costs (IDCs)may be

Q35: When depreciating 5-year property,the final year of

Q45: If no gain is recognized in a

Q60: Sonya started a self-employed consulting business in

Q64: Scott provides accounting services worth $40,000 to

Q71: Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property

Q92: During the year,Jim incurs $50,000 of rehabilitation

Q93: All of the following are true except:<br>A)A

Q98: Regulations issued prior to the latest tax