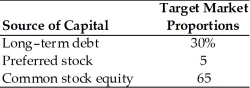

A firm has determined its optimal capital structure,which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value.The stock will pay an $8.00 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share.The dividend expected to be paid at the end of the coming year is $5.07.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.45.It is expected that to sell,a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Share Options

A privilege, sold or granted, that gives the holder the right, but not the obligation, to buy or sell shares at a specified price within a predetermined time.

Remuneration Expense

This refers to the total cost incurred by a business for paying salaries, wages, and other forms of compensation to its employees.

Vesting Period

The time period during which an employee earns rights to employer-contributed benefits, such as retirement fund contributions or stock options.

Q8: _ is one way of assessing an

Q24: Minna is a 50% owner of a

Q52: A corporation is owned 70% by Jones

Q86: The correlation coefficient is an index of

Q88: A corporation who makes a charitable contribution

Q108: For corporations,NSTCLs and NLTCLs are treated as

Q112: Any bond rated Aaa through Caa according

Q131: Restrictive covenants place operating and financial constraints

Q167: What is the expected return for Asset

Q200: Perfectly _ correlated series move exactly together