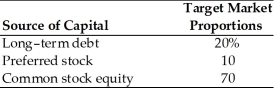

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Congestive Heart Failure

A chronic condition in which the heart is unable to pump blood efficiently, leading to symptoms like shortness of breath and fluid retention.

Stress Urinary Incontinence

A condition characterized by the involuntary leakage of urine due to pressure or stress on the bladder, such as during coughing or exercise.

Ultrasonic Renal Bladder

The use of high-frequency sound waves to create images of the kidney and bladder, often for diagnostic purposes.

Urinary Tract Infections (UTIs)

Infections that occur in any part of the urinary system including the kidneys, ureters, bladder, and urethra, often caused by bacteria.

Q15: The portfolio with a standard deviation of

Q52: The steeper the slope of the security

Q59: Common stock can be either privately owned

Q60: What is the risk-free rate of return

Q65: Richard has a 50% interest in a

Q85: The relevant portion of an asset's risk,attributable

Q87: Asset P has a beta of 0.9.The

Q90: The constant-growth model uses the market price

Q93: The firm's before-tax cost of debt is

Q154: Which of the following is a difference