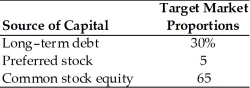

A firm has determined its optimal capital structure,which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value.The stock will pay an $8.00 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share.The dividend expected to be paid at the end of the coming year is $5.07.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.45.It is expected that to sell,a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Chemistry II

An advanced course in chemistry, typically covering more complex concepts and experiments beyond introductory levels.

Actors Improvised

When performers create spontaneous dialogue or action within the context of a performance without a script.

Scenes

Specific locations or settings where action takes place within a play, movie, book, or other narrative mediums.

Washington, D.C.

The capital city of the United States, known for housing the federal government's three branches and various national monuments.

Q17: Discuss whether a C corporation,a partnership,or an

Q28: Chi transfers assets with a $150,000 FMV

Q28: What are some of the factors to

Q32: Which of the following characteristics belong(s)to the

Q43: If bankruptcy were to occur,_ would have

Q72: Felicia contributes property with a FMV of

Q108: If a corporation faces a tax rate

Q120: What would be the cost of retained

Q145: Combining two less than perfectly positively correlated

Q168: Combining two assets having perfectly positively correlated