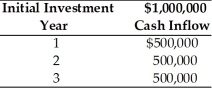

Table 11.7

A firm is considering investment in a capital project which is described below.The firm's cost of capital is 18 percent and the risk-free rate is 6 percent.The project has a risk index of 1.5.The firm uses the following equation to determine the risk adjusted discount rate,RADR,for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-The discount rate that should be used in the net present value calculation to compensate for risk is ________.(See Table 11.7)

Definitions:

Metastatic Tumors

Tumors that have spread from their original location to other parts of the body, typically leading to more severe health complications.

Neoplasms

Neoplasms are abnormal masses of tissue that result from excessive, uncoordinated growth of cells and can be benign or malignant (cancerous).

Oncogene

An abnormally functioning gene implicated in causing cancer. Compare with proto-oncogene and tumor suppressor gene.

Cell Signaling

Mechanisms of communication between cells. Cells signal one another with secreted signaling molecules, or a signaling molecule on one cell combines with a receptor on another cell. See signal transduction.

Q22: If a developer does not have sufficient

Q33: Which of the following is NOT a

Q44: In general,a low times interest earned ratio

Q51: The informational content of dividends refers to

Q55: The capital budgeting process consists of five

Q103: _ pool investment capital,make risky investment decisions,and

Q108: The degree of operating leverage depends on

Q115: The IRR is the compounded annual rate

Q128: Which of the following must be considered

Q172: RADRs are popular because they are consistent