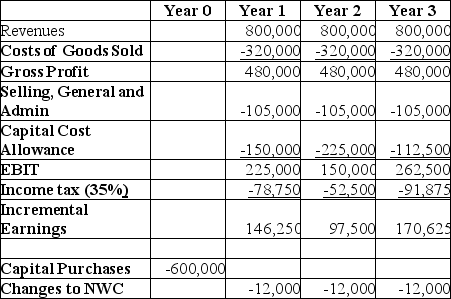

Cromwell Industries is considering a new project which will have costs,revenues,etc.as shown by the data above.If the cost of capital is 8.5%,what is the net present value (NPV) of this project?

Cromwell Industries is considering a new project which will have costs,revenues,etc.as shown by the data above.If the cost of capital is 8.5%,what is the net present value (NPV) of this project?

Definitions:

Overstated

When financial information or figures are represented to be more significant or higher than they actually are.

Q3: 5-75 The front-end load on these type

Q7: A $10,000 bond with a coupon rate

Q30: 3-2 Due to a recent increase in

Q44: The free cash flow for the last

Q45: Preference for cash today versus cash in

Q50: Interest and other financing-related expenses are excluded

Q51: Cameron Industries is purchasing a new chemical

Q62: Internal rate of return (IRR)can reliably be

Q77: 1-44 The proportion of financial assets controlled

Q100: An analysis that breaks the net present