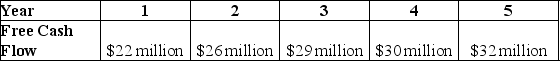

Use the table for the question(s) below.

-General Industries is expected to generate the above free cash flows over the next five years,after which free cash flows are expected to grow at a rate of 3% per year.If the weighted average cost of capital is 8% and General Industries has cash of $10 million,debt of $40 million,and 80 million shares outstanding,what is General Industries' expected current share price?

Definitions:

Report Feelings

The act of expressing or documenting one's emotions, sensations, or moods, often used in psychological or medical contexts.

Neutral Moods

Emotional states that are neither distinctly positive nor negative, often characterized by a lack of strong feelings one way or the other.

Depressed Person

An individual experiencing a state of low mood and aversion to activity, affecting their thoughts, behavior, feelings, and sense of well-being.

Inner Processes

The internal mental and emotional mechanisms that guide thoughts, feelings, and behaviors in individuals.

Q21: 2-36 The DIDMCA of 1980 and the

Q34: A company buys tracking software for its

Q48: A small business refits its store.The builders

Q49: A Government of Canada zero-coupon bond has

Q77: 1-44 The proportion of financial assets controlled

Q79: Jeff has the opportunity to receive lump-sum

Q92: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The price (expressed

Q94: How can we take a financial decision

Q114: Which of the following best explains why

Q117: Which of the following is the best