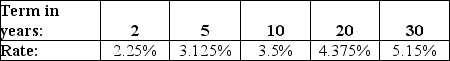

The table above shows the interest rates available from investing in risk-free Government of Canada securities with different investment terms.If an investment offers a risk-free cash flow of $100,000 in ten years' time,what is the present value (PV) of that cash flow?

The table above shows the interest rates available from investing in risk-free Government of Canada securities with different investment terms.If an investment offers a risk-free cash flow of $100,000 in ten years' time,what is the present value (PV) of that cash flow?

Definitions:

Consolidation

The process of combining the financial statements of a parent company with those of its subsidiaries to present as if the group of companies was a single economic entity.

Q23: Given a real interest rate of 2.5%

Q31: If your firm's borrowing cost is 10%

Q38: Which of the following risk-free,zero-coupon bonds could

Q42: A farmer decides to lease a new

Q46: Generally speaking,if the asset's CCA deductions are

Q49: The Law of One Price states that

Q67: In the method of comparables,the known values

Q76: The one-year discount factor is the discount

Q99: A McDonald's Big Mac value meal consists

Q110: What is the effective annual rate (EAR)?<br>A)the