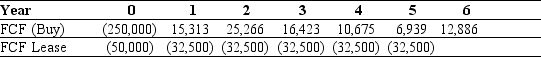

Use the table for the question(s) below.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 10% and the tax rate is 40%,what is the amount of the lease-equivalent loan for the new equipment?

Definitions:

AMT Income

AMT Income refers to the income calculation used to determine the Alternative Minimum Tax, designed to prevent high-income taxpayers from excessively reducing their tax liability through credits and deductions.

Phase Out

A gradual reduction of a tax credit or deduction as a taxpayer's income surpasses a designated threshold.

Minimum Tax Exemption

An amount exempt from alternative minimum tax (AMT), designed to ensure that taxpayers with substantial income pay at least a minimum amount of tax.

Book Income

The income calculated for accounting purposes, rather than for tax purposes, often used to measure a company's financial performance.

Q7: Which of the following best describes a

Q9: Which short-term financing policy states that short-term

Q27: You are interested in purchasing a new

Q28: Greentree Holdings has announced plans to acquire

Q39: A lease in which the lessor is

Q39: Diwali Airlines has a contract that gives

Q53: What can be considered the firm's permanent

Q55: Which of the following is a suspect

Q95: If the benefit of a lower rate

Q102: To cover the costs that result if