Use the table for the question(s) below.

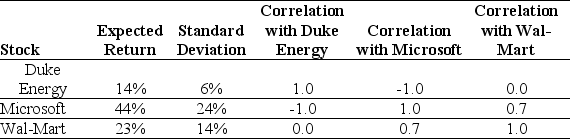

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

Definitions:

Activity Variance

A measure of the difference between planned or budgeted activity levels and actual activity levels.

Personnel Expenses

Costs related to the compensation and benefits of a company's employees.

Budgeting

A process of creating a plan to spend your money, allowing you to determine in advance whether you will have enough money to do the things you need or want to do.

Activity Variance

The difference between the expected cost of an activity and its actual cost, often used in budgeting and cost management to analyze performance.

Q18: The following data represent selected information from

Q27: The financial statement that reports cash receipts

Q47: What are the four IPO puzzles?

Q54: Why do we use market values rather

Q68: When a firm's investment decisions have different

Q77: Why should an investor invest in a

Q78: Agency costs arise when:<br>A)there are high labour

Q84: Investors can buy stock to:<br>A)earn a return

Q102: Under the indirect method of preparing a

Q102: When would a firm choose to call