Use the table for the question(s) below.

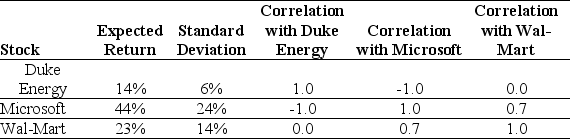

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to:

Definitions:

Catalog Price

The price listed in a catalog, not accounting for any discounts or promotions.

Credit Terms

Credit Terms are the payment terms and conditions established by a seller, including the period that has to pass before an invoice is considered overdue.

Cost Of Goods Sold

The direct costs attributable to the production of goods sold by a company, including materials and labor.

Beginning Inventory

The value of goods available for sale at the start of an accounting period, carried over from the end of the previous period.

Q2: As part of the registration statement,the preliminary

Q11: Red flags in financial statement analysis can

Q19: Which of the following statements regarding angel

Q24: For each 1% change in the market

Q35: The average annual return over the period

Q44: Which of the following combinations of stocks

Q47: Which of the following statements is TRUE?<br>A)On

Q61: A firm raising capital by issuing callable

Q75: Which of the following best describes those

Q108: It is generally considered more useful to