Use the table for the question(s) below.

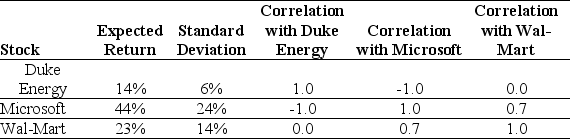

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to:

Definitions:

Goals And Incentives

Objectives set by an organization to guide its actions and the motivational tools or rewards used to encourage desired behaviors among its stakeholders.

Supply Chain Coordination

Aligning and integrating the activities among all participants in the supply chain to improve efficiency and responsiveness to market demands.

Product Visibility

The ability to track and view the status and location of products throughout the supply chain, from production to delivery.

Order Synchronization

The coordination of all activities involved in fulfilling customer orders, ensuring that each component arrives at the right place and time for final assembly and shipment.

Q5: The book value of equity of a

Q38: American options allow their holders to exercise

Q53: If all else is held equal, an

Q58: Debt holders can be thought as owning

Q66: The price of a European call option

Q86: Assume that you purchased Ford Motor Company

Q92: A protective put written on a portfolio

Q98: Companies can have investing and financing activities

Q109: Operating activities are related to the transactions

Q125: Which of the following groups of ratios