Use the table for the question(s) below.

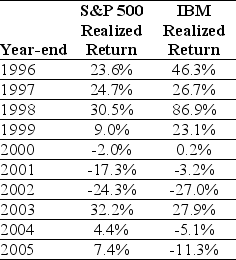

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 67% confidence interval for 2010 returns?

Definitions:

Dispersal Pattern

The way in which individuals in a population space themselves out over their environment, influencing population dynamics and community structure.

K-selected

Characterizes species that produce fewer offspring, with a larger investment in each, typically adapting to stable environments where competition is strong.

Biotic Potential

An organism’s greatest capability to reproduce in the best possible environmental circumstances.

Q11: Earnings per share is computed for which

Q25: The risk premium is the difference between

Q34: A European option with a later exercise

Q42: Which of the stock markets listed below

Q47: What are the four IPO puzzles?

Q59: Red Deer Plumbing Supply Co.earns $4.50 per

Q99: The average annual return on IBM from

Q104: Ford Motor Company is discussing new ways

Q105: The holder of a put option has:<br>A)the

Q121: Corporations generally credit Income Tax Payable based