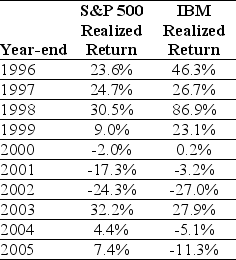

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for small stocks is 22.1%,and the standard deviation of returns is 22.1%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

Definitions:

Sherman Act

A foundational antitrust law in the United States aimed at prohibiting monopolies and other practices that restrain free competition.

Price-Fixing

An illegal agreement among competitors to fix, raise, or lower the price of a product or service, rather than allowing the market to determine prices naturally.

Interlocking Directorates

The practice of members of a corporate board of directors serving on the boards of multiple corporations, often leading to increased corporate cohesion and shared interests.

Celler-Kefauver Act

A U.S. law, enacted in 1950, designed to prevent anti-competitive mergers and acquisitions by closing loopholes in earlier antitrust legislation.

Q14: Garwood Garages will pay a dividend of

Q20: This graph depicts the payoffs of a:<br>A)short

Q29: If two stocks are perfectly negatively correlated,a

Q39: The writer of a call option has:<br>A)the

Q49: The following data represent selected information from

Q54: Why do we use market values rather

Q55: If a broker will buy a share

Q59: The purchase of treasury stock would be

Q70: Which of the following statements is TRUE?<br>A)The

Q78: Phoenix Rising Corporation sold an unused building