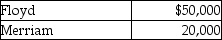

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  Floyd agrees to sell off half of his share to Ramelow in exchange for $30,000 cash. Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

Floyd agrees to sell off half of his share to Ramelow in exchange for $30,000 cash. Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

Definitions:

Q5: The debt to equity ratio of four

Q26: _ are equity securities in which the

Q42: On December 1, 2015, Parsons Inc. sold

Q48: Which of the following types of stock

Q54: FICA tax is a tax which is

Q57: A deficit occurs when a company has

Q67: On January 1, 2013, Davie Services issued

Q73: Which of the following corporate characteristics is

Q84: Floyd and Merriam start a partnership business

Q101: Jade Investments purchased 40% of the common