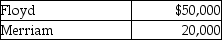

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  They agreed to admit Ramelow into the business for a one-third interest in the new partnership. He had to bring in a cash contribution of $20,000 for the same. Which of the following is the correct capital account balance of Ramelow after he enters the business?

They agreed to admit Ramelow into the business for a one-third interest in the new partnership. He had to bring in a cash contribution of $20,000 for the same. Which of the following is the correct capital account balance of Ramelow after he enters the business?

Definitions:

Treatment Programs

Treatment programs are structured plans or interventions designed to address specific health issues, disorders, or diseases, and may include medication, therapy, counseling, or lifestyle modifications.

Attendance Sheet

is a document used to record the presence of individuals at an event, meeting, or class.

Compound Interest

Interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan.

Simple Interest

Interest calculated on the principal portion of a loan or deposit, without compounding on the interest previously earned.

Q27: Ferro Inc. signed a 200-day, 5%, $5,000

Q46: An equity security represents a credit relationship

Q57: A deficit occurs when a company has

Q61: A general partner in a limited partnership:<br>A)has

Q71: Farrell and Jimmy enter into a partnership

Q81: Simonsen, Paulson, and Richardson are partners in

Q89: Frank and Harry are partners. Frank has

Q96: If a company retires preferred stock:<br>A)total stockholders'

Q103: A note payable can either be classified

Q137: Which of the following is a characteristic