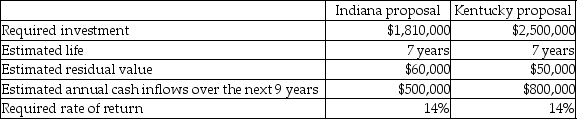

O'Mally Department Stores is considering two possible expansion plans. One proposal involves opening 5 stores in Indiana at the cost of $1,810,000. Under the other proposal, the company would focus on Kentucky and open 6 stores at a cost of $2,500,000. The following information is available:  The payback period for the Indiana proposal is closest to

The payback period for the Indiana proposal is closest to

Definitions:

International Fisher Effect

A theory stating that the difference in nominal interest rates between two countries is equal to the expected change in exchange rates.

Expected Percentage Change

An estimation of the degree to which a specific variable such as price, cost, or investment value is anticipated to vary over a certain period.

Interest Rates

The percentage of a loan that is applied as interest for the borrower, usually shown as an annual percentage of the remaining loan amount.

Uncovered Interest Parity

A theory in economics that posits the difference in interest rates across two countries will match the anticipated shift in exchange rates between their currencies.

Q28: Selected information about the Thomas Trucks Company

Q30: The payback and accounting rate of return

Q45: Osprey Company is evaluating two possible investments

Q72: Solve the following two cases (the cases

Q78: Icy Peaks Sports makes snowboards. The company

Q128: Camping World Corporation has operating income of

Q142: Under the direct method of cash flow

Q160: The master budget variance is the difference

Q175: Krazy Kayaks sells its entry-level kayaks for

Q185: Selected financial data for the Photocopies Division