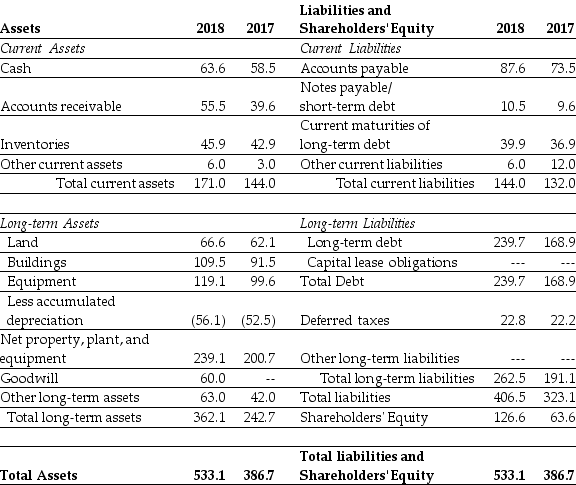

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

-Refer to the balance sheet above. If in 2017, Luther has 5.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to:

Definitions:

Liquidated Damages

A predetermined amount of money that must be paid as damages for failure to perform under a contract.

Reliance Damages

Compensation awarded for losses suffered as a result of relying on a promise or agreement, even if a contract was never formalized.

Lost Profits

Refers to the income that a business could have earned but was unable to due to some form of disruption or another party's actions.

Misrepresentation

A false statement of fact made by one party to another, which has the effect of inducing that party into a contract.

Q2: A 10-year, zero-coupon bond with a yield

Q20: The formula used in vertical analysis of

Q29: Consider the above Income Statement for Xenon

Q35: Large corporations that do not issue sustainability

Q50: Which of the following organizations has developed

Q64: If the exchange rates, after fees, in

Q66: Gavette Company reported the following information for

Q76: A company uses the direct method to

Q78: Put the following steps of the financial

Q98: Assuming that Luther's bonds receive a AAA