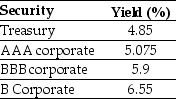

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The price (expressed as a percentage of the face value) of a one-year, zero-coupon, corporate bond with a BBB rating is closest to:

Definitions:

Sustainable Growth Rate

The maximum rate at which a company can grow using its generated profits without resorting to external financing.

Capital Intensity Ratio

A metric that measures the amount of capital needed per unit of output, indicating the extent to which a firm or economy relies on capital to produce goods and services.

Retention Ratio

The proportion of earnings that is not distributed as dividends to shareholders, but is retained by the company for reinvestment.

Cash Dividends

Distributions of profits from a corporation to its shareholders as payments.

Q2: When the costs of an investment come

Q22: Which alternative offers you the lowest effective

Q30: How can we make a financial decision

Q43: Which of the following statements is FALSE?<br>A)When

Q69: Assuming that your capital is constrained, which

Q82: The owner of a hair salon spends

Q83: Melissa is saving for a car. She

Q83: The yield to maturity for the three-year

Q88: Cost-benefit analysis cannot be performed in cases

Q97: You are in the process of purchasing