Use the information for the question(s) below.

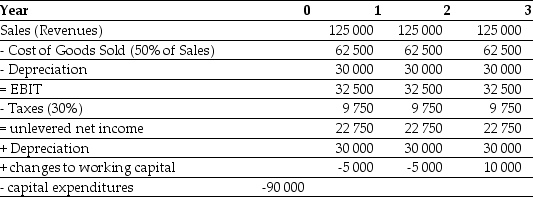

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-A firm is considering a new project that will generate cash revenue of $1 000 000 and cash expenses of $700 000 per year for five years. The equipment necessary for the project will cost $200 000 and will be depreciated using the straight-line method over four years. What is the expected free cash flow in the second year of the project if the firm's marginal tax rate is 30%?

Definitions:

Intelligence Test Scores

Numeric scores derived from assessments designed to measure human intelligence and cognitive abilities.

Racial Groups

Categories of humans based on physical characteristics, ancestry, genetics, or social affiliation.

Gender Gap

The disparities between men and women in various aspects of life, including but not limited to social, political, intellectual, cultural, or economic attainments or attitudes.

Mathematical Abilities

The capability to perform mathematical processes and understand mathematical concepts.

Q4: A bond that makes payments in a

Q10: A firm has $2 million market value

Q12: The below screen shot from Google Finance

Q28: The founders and owners of a private

Q59: Convex Incorporated sells 10 million shares in

Q64: Of the following four mutually exclusive investments,

Q78: How do we handle interest expense when

Q83: The expected return is usually _ the

Q85: A real option is the right, but

Q91: Cameron Industries is purchasing a new chemical