Use the information for the question(s) below.

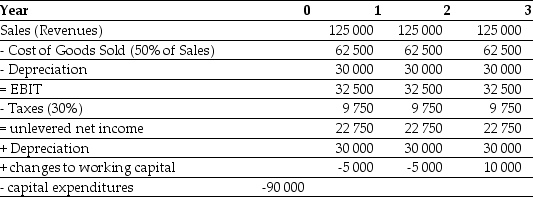

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-Luther Industries has outstanding tax loss carryforwards of $70 million from losses over the past four years. If Luther earns $15 million per year in pre-tax income from now on, in how many years will Luther first pay taxes?

Definitions:

CCA Class

Refers to the categories under the Canadian tax system specifying the depreciation rate that can be claimed on assets for tax purposes.

Q2: Assume the appropriate discount rate for this

Q26: The Sisyphean Company is currently trading for

Q42: Suppose you invest in 100 shares of

Q49: The internal rate of return (IRR)rule will

Q54: Assume your current mortgage payment is $900

Q55: Panjandrum Industries, a manufacturer of industrial piping,

Q57: Your estimate of the market risk premium

Q61: David founds a company and goes through

Q64: Of the following four mutually exclusive investments,

Q97: You are in the process of purchasing