Use the information for the question(s) below.

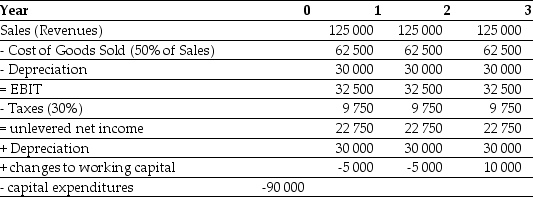

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-A firm is considering a new project that will generate cash revenue of $1 000 000 and cash expenses of $700 000 per year for five years. The equipment necessary for the project will cost $200 000 and will be depreciated using the straight-line method over four years. What is the expected free cash flow in the second year of the project if the firm's marginal tax rate is 30%?

Definitions:

Fraternal Twins

Twins that develop from two separate eggs fertilized by two different sperm, resulting in siblings that are genetically distinct.

Cerebral Hemispheres

The two halves of the brain, each responsible for different functions and controls the opposite side of the body.

Function

The specific role or activity that something is designed or used for, or the natural purpose of a biological process or organ.

Hemispheric Specialization

The idea that the two hemispheres of the brain are functionally different and certain mental processes and behaviors are mainly controlled by one hemisphere.

Q11: What is the yield to maturity of

Q16: What is a safe method to use

Q17: The market or equity risk premium can

Q26: Since your first birthday, your grandparents have

Q26: Suppose you invest in 200 shares of

Q31: You expect that Bean Enterprises will have

Q71: Why does the option to abandon a

Q79: Which of the three costs-debt, preference share

Q86: Volatility a reasonable measure of risk when

Q92: What must be the price of a