Use the figure for the question(s) below.

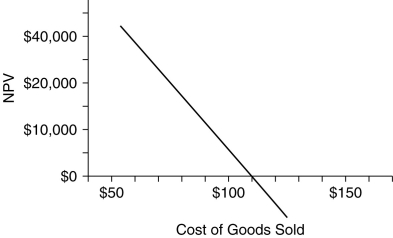

-A maker of kitchenware is planning on selling a new chef-quality kitchen knife. The manufacturer expects to sell 1.6 million knives at a price of $120 each. These knives cost $80 each to produce. Selling, general, and administrative (SG&A) expenses are $500 000. The machinery required to produce the knives cost $1.4 million, depreciated by straight-line depreciation over five years. The maker determines that the EBIT break-even point for units sold and sale price is less than these estimates and that the EBIT break-even point for costs per unit, SG&A, and depreciation are greater than these estimates, so decides to go ahead with manufacturing the knife. Was this the correct decision?

Definitions:

Proximity Hypothesis

The theory that individuals will form relationships or have positive feelings towards things or people that are physically close to them.

Frequency Paradox

A concept indicating the mismatch between the perceived frequency of occurrence of an event and its actual frequency.

Expert Power

The influence one possesses owing to one's expertise, skills, or knowledge in a specific domain.

Referral

The act of directing someone to a different place or person for information, help, or action.

Q4: A bond that makes payments in a

Q5: A firm issues 20-year bonds with a

Q17: An advantage of the 'valuation multiple method'

Q25: Your firm is considering building a new

Q29: What are 'project externalities'?

Q32: If your new shopping centre will have

Q44: The market value of Fortescue's ordinary shares,

Q59: You are offered an investment opportunity that

Q63: The outstanding debt of Billabong has 10

Q85: Private debt can be in the form