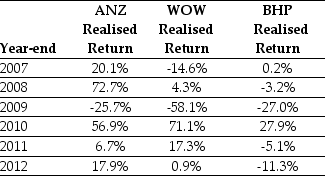

Use the table for the question(s) below.

Consider the following returns:

-The volatility on ANZ returns is closest to:

Definitions:

Credit Instrument

A document that evidences a debt and the promise of repayment, such as bonds, notes, or mortgages.

Transferor's Warranties

Guarantees made by a seller (transferor) to a buyer about the condition, legality, and ownership status of the goods or property being sold.

Presenter's Warranties

Guarantees made by the presenter of a negotiable instrument, such as a check, regarding its legitimacy and their authority to present it.

Implied Warranties

Legal guarantees assumed in a transaction, suggesting that a product will meet certain standards even if not explicitly stated.

Q4: Which of the following bonds will be

Q10: A delivery service is buying 600 tyres

Q13: Cameron Industries is purchasing a new chemical

Q14: An 'original issue discount bond' is a

Q18: A 20-year bond with a $1 000

Q24: Valence Electronics has 217 million shares on

Q48: Suppose you bought a $55 share a

Q51: The founders and owners of a private

Q59: What considerations should managers have while deciding

Q75: A share market comprises 2 000 shares