Use the table for the question(s) below.

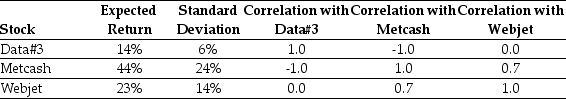

Consider the following expected returns, volatilities and correlations:

-A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What proportion of the market portfolio is comprised of each company?

Definitions:

Maximization

The process of seeking the highest possible outcome or result from a set of choices or actions.

Base Rates

Basic pay rates established for roles or tasks before any additional benefits or allowances are added.

Not-invented-here Bias

A mindset or culture where innovations or solutions developed outside a particular group are undervalued or rejected, regardless of merit.

Conservative Decisions

Decision-making approaches that prioritize risk-aversion and stability, often favoring traditional methods over innovative solutions.

Q4: For large portfolios, investors should expect a

Q10: The volatility of your investment is closest

Q19: Tompkinson's PLC, a British company, issues a

Q37: The difference between scenario analysis and sensitivity

Q40: A company has a market value of

Q58: Assuming that Luther's bonds receive a AAA

Q59: When a callable bond sells at a

Q77: Which of the following equations is INCORRECT?<br>A)R<sub>p</sub>

Q81: The post-money valuation of your firm is

Q85: Which of the following equations would NOT