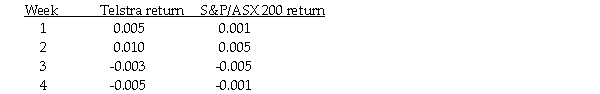

You observe that Telstra shares and the S&P/ASX 200 index have the following weekly returns:  If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

Definitions:

Satiety

is the feeling of being full or satisfied, typically experienced after eating, which reduces the desire to eat more.

Fat-soluble Vitamins

Vitamins A, D, E, and K, which are absorbed along with fats in the diet and can be stored in the body's fatty tissue.

Proteins

Large, complex molecules essential for the structure, function, and regulation of the body's cells, tissues, and organs.

Fiber

The tough, stringy part of vegetables and grains, which is not absorbed by the body but aids in a variety of bodily functions.

Q2: A maker of kitchenware is planning on

Q16: Which of the following statements is FALSE?<br>A)The

Q25: Rylan Industries is expected to pay a

Q31: The announcement of an SEO usually decreases

Q33: Cameron Industries is purchasing a new chemical

Q48: Which of the following statements is FALSE?<br>A)Usually,

Q76: A 'call feature' allows the issuer of

Q81: IGM Realty had a price of $30,

Q85: A real option is the right, but

Q92: Luther Industries currently has 100 million shares