Use the table for the question(s) below.

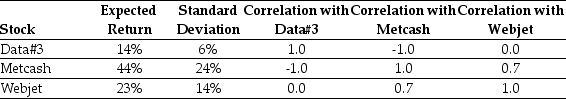

Consider the following expected returns, volatilities and correlations:

-A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What proportion of the market portfolio is comprised of each company?

Definitions:

Budget Line

The Budget Line is a graphical representation of all possible combinations of two goods that can be purchased with a given income level and prices.

Income Increases

Refers to a rise in the amount of money earned by individuals or households, which can influence their purchasing power and consumption patterns.

Marginal Utility

The supplementary satisfaction or advantage gained upon consuming an extra unit of a good or service.

Football Tickets

Specific passes that allow entry to football (soccer or American football) games.

Q1: The implications of the efficient markets hypothesis

Q3: The standard deviation for the return on

Q22: The average annual return on the All

Q27: Dividend payments that are the result of

Q31: A security company offers to provide CCTV

Q38: Common risk is also called 'correlated risk'.

Q54: A bank loan is not a form

Q56: Most practitioners would use net debt when

Q58: An asset-backed bond will have the greatest

Q83: The cash flows for four projects are