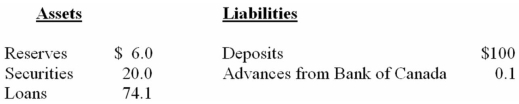

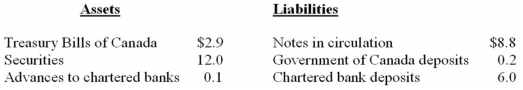

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers;that is,do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.

CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM

BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA

-Refer to the above information.The chartered banks have excess reserves of:

Definitions:

Prospect Theory

A psychological theory that describes how people make decisions based on the potential value of losses and gains rather than the final outcome.

Endowment Effect

A psychological phenomenon where people ascribe more value to things merely because they own them.

Prospect Theory

A behavioral economic theory that describes how people make decisions under conditions of risk and uncertainty, prioritizing losses differently from gains.

Framing Effect

A cognitive bias where people decide on options based on whether they are presented in positive or negative terms.

Q25: Suppose the ABC bank has excess reserves

Q38: Refer to the above information.Suppose that customers

Q69: Other things equal,a decrease in the price

Q76: One major advantage of the medium of

Q97: During the last decade,the gross federal public

Q148: Securitization is the process of slicing up

Q163: Which of the following is one of

Q179: If the MPC in an economy is

Q181: Refer to the above information.Beta would prefer

Q203: An expansionary monetary policy that is used