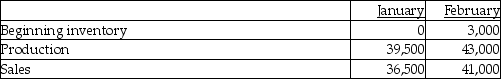

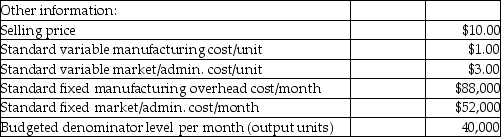

Use the information below to answer the following question(s) .Urban Body Products Ltd.manufactures body wash liquid soap.The controller has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.

-Which of the following is correct concerning variable vs absorption costing?

Definitions:

Variable Overhead Spending Variance

The difference between the actual variable overheads incurred and the expected costs based on standard overhead rates.

Standard Quantity

The expected or predetermined amount of materials or input required to produce a single unit of product.

Standard Price

A predetermined cost assigned to materials, labor, and overhead, used as a benchmark against which the actual costs are compared.

Q3: In Gray's framework for accounting system development,

Q17: What is effective control?<br>A) Assets bought and

Q22: What is a "contingent asset?"<br>A) There is

Q25: Camerata Construction borrowed €19,000,000 for 10 years

Q38: Delivering value to the customer requires executing

Q48: What will be Fair Score Company's budgeted

Q53: A fixed manufacturing overhead cost pool can

Q64: What is Regal Company's budgeted fixed overhead

Q84: What will be Country Heather's budgeted revenue?<br>A)$216,000<br>B)$240,000<br>C)$312,000<br>D)$318,000<br>E)$300,500

Q143: When a journal entry is made in