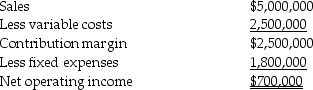

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions.The division managers are evaluated, in part, on the basis of the change in their return on invested assets.Operating results for the Packer Division for the upcoming year are budgeted as follows:

Total assets for the division are currently $3,600,000.For next year the division can add a new product line for an investment of $600,000.The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually.Variable costs of the new product will average 60 percent of selling price.Required:

Total assets for the division are currently $3,600,000.For next year the division can add a new product line for an investment of $600,000.The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually.Variable costs of the new product will average 60 percent of selling price.Required:

a.What will be the company's ROI after accepting the new product line?

b.If the company's required rate of return is 6 percent, and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Definitions:

Interest Rate

The cost of borrowing money, typically expressed as a percentage of the amount borrowed, paid to the lender.

Average Price

The sum of the prices of all units sold divided by the quantity of units, providing a central value that typifies the price level within a specific market.

Savings And Loan Associations

Organizations that primarily accept savings deposits and distribute loans, including mortgages, to borrowers.

Declining Real Estate

A situation where the value and demand for real estate decrease over time, often due to economic factors or oversupply.

Q22: Weston Ltd.is considering investing in a new

Q50: Current cost is defined as the cost

Q57: Raw materials that can be traced to

Q64: Activity-based costing can "unlock" savings, not apparent

Q68: Which type of compensation is most prevalent

Q96: Nearly all accounting systems accumulate forecasted costs.

Q115: An ABC system is one building block

Q119: Compared to an activity-based cost system, CP8

Q121: Informal management control systems include<br>A)incentive plans.<br>B)codes of

Q137: CCA reduces taxable income, and therefore reduces