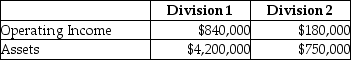

Stratton Industries has two divisions.These divisions reported the following results for the year just ended:

Required:

Required:

a.Calculate the ROI for each division.Which division would you consider to be the most successful? Why?

b.Now assume that the company requires a 14% minimum rate of return.Calculate the residual income for each division.Which division would you consider to be the most successful? Why?

Definitions:

FICA Taxes

Taxes required by the Federal Insurance Contributions Act, funding Social Security and Medicare, deducted from employees' paychecks and matched by employers.

Social Security

A government program providing economic assistance to persons with inadequate or no income, funded by taxes on workers and employers.

Medicare Benefits

Medicare benefits refer to the health care services covered under Medicare, a United States federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant).

FICA Tax

Federal Insurance Contributions Act tax used to finance federal programs for old-age and disability benefits (social security) and health insurance for the aged (Medicare).

Q17: Variable operating costs and fixed operating costs

Q26: Broughton Industries Ltd.is a publicly traded company

Q33: Actual costing traces direct costs to a

Q34: John wants to identify the total cost

Q39: The following data are available for a

Q47: Better Battery has been in the battery

Q92: Which of the following is an assumption

Q101: Return on investment is also called the

Q126: When the present value of expected cash

Q154: Which of the following is TRUE concerning