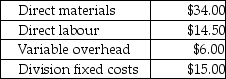

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

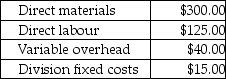

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

Definitions:

Q11: The three alternatives for increasing return on

Q21: The net present value method is a

Q40: A decrease in the tax rate will

Q50: Instead of proration, a company could choose

Q61: Mrs.Tisdale is going to sell Christmas tree

Q75: Schulz Corporation applies overhead based upon machine-hours.Budgeted

Q118: Which of the following statements would be

Q131: For the period just ended, Trident Ltd.reported

Q142: If the Assembly Division sells 100,000 pairs

Q172: The general guideline for determining the minimum