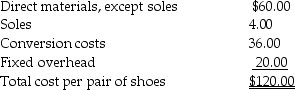

The Brownshoe Company has three specialized divisions.The Casual Shoe Division has asked the Sole Division to supply it with a large quantity of soles.The Sole Division is currently at capacity.The Sole Division sells soles outside for $5.00 each.The Casual Shoe Division, which is operating at 50 percent capacity, has offered to pay $4.00 per sole.The Sole Division has a variable cost of $3.60 per sole.The Casual Shoe Division has the following cost structure:

The manager of Casual Shoe believes that the $4 price from Sole is necessary if the division is to compete in the market for casual shoes.Required:

The manager of Casual Shoe believes that the $4 price from Sole is necessary if the division is to compete in the market for casual shoes.Required:

a.As manager of Sole Division, would you recommend that your division supply the soles to Casual Shoe? Why?

b.Would it be desirable for the division to supply Casual Shoe with the soles for $4 assuming the Sole Division had excess capacity? Why?

c.What would be the corporate position assuming the Sole Division has excess capacity?

Definitions:

Pendleton Act

Legislation passed in 1883 that established the United States Civil Service Commission, which ended the spoils system and made merit the basis for hiring and promoting in the federal service.

Merit System

An approach to hiring and promoting government employees based on their ability and performance rather than political connections or factors.

Political Appointment System

A system where government officials are appointed based on their political affiliations and loyalty rather than merit or competitive examination.

Career Civil Servants System

A system employing individuals who work for the government and are selected based on merit rather than appointed or elected, providing continuity within the bureaucracy.

Q1: You have just been hired as the

Q18: Unit costs are considered to be an

Q48: The amount of manufacturing overhead allocated to

Q75: Paymaster Company provided the following information for

Q96: The Production Division has no alternative use

Q113: Calculate last year's operating income when the

Q140: The choice of a transfer-pricing method has

Q144: Following is the Becker Company Ltd.partial income

Q145: Operating income does not include interest expense

Q150: Shirt Company wants to purchase a new