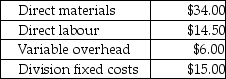

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

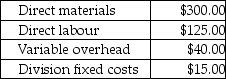

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division.The Compressor Division's operating income is

Definitions:

Extraverted

Describing a personality trait characterized by outgoingness, sociability, and a high level of engagement with the external world.

Conform

The act of adjusting one's behavior or beliefs to align with the norms or standards of a group or society.

Self-esteem

An individual's overall subjective emotional evaluation of their own worth.

Self-efficacy

Self-efficacy is the belief in one's ability to succeed in specific situations or accomplish a task.

Q7: What is the transfer price per kilogram

Q20: The Holiday Card Company, a producer of

Q34: To calculate the break-even point in a

Q37: Batman Abstract Company has three divisions that

Q52: Manufacturing firms have three types of inventory:

Q74: One reason companies use full-cost transfer pricing

Q89: Merchandising-sector companies<br>A)purchase materials and convert them to

Q96: A corporation has a required rate of

Q152: A Canadian company has subsidiaries in France,

Q159: Coptermagic Company supplies helicopters to corporate clients.Coptermagic