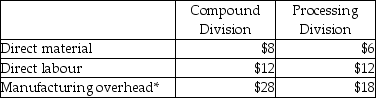

Payne Ltd.has two divisions.The Compound Division makes QZ54, an industrial compound, which is then transferred to the Processing Division.The Processing Division further processes the QZ54 and sells the final product to customers at $87/kg.Capacity in the Compound Division is 800,000 kg.QZ54 can be obtained on the external market at $50/kg Data regarding the costs per kilogram in each division are presented below:

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total.Fixed overhead rates are based on capacity of 800,000 kg.in each division.In addition to the manufacturing costs, the Compound Division would incur $2 per kilogram of selling costs which would be avoided on internal transfers.Similarly the Processing Division would avoid $3/kg.of ordering costs on internal purchases.Required:

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total.Fixed overhead rates are based on capacity of 800,000 kg.in each division.In addition to the manufacturing costs, the Compound Division would incur $2 per kilogram of selling costs which would be avoided on internal transfers.Similarly the Processing Division would avoid $3/kg.of ordering costs on internal purchases.Required:

a.Calculate the operating incomes for each division assuming 800,000 kg.of QZ54 are transferred and the company uses a market transfer price.

b.Calculate the operating incomes for each division assuming 800,000 kg.of QZ54 are transferred and the company uses a transfer pricing policy based on 125% of absorption manufacturing cost.

c.Comment on your calculations in a and b in terms of the respective division managers preferences.

d.Should the company transfer its 800,000 kg.assuming the Compound Division can sell all of its output on the external market?

Definitions:

Unlicensed Agent

An individual acting in a role that requires licensure, such as real estate or insurance, without possessing the necessary legal authorization.

Professional Acts

Actions or conduct that are considered appropriate, ethical, and in accordance with the standards of a profession.

Realtor

A real estate professional who is a member of the National Association of Realtors and adheres to its code of ethics.

Agency Relationship

A fiduciary relationship where one party (the principal) grants another party (the agent) the authority to act on their behalf in transactions.

Q7: What is the transfer price per kilogram

Q29: How many units would have to be

Q48: Factors affecting direct/indirect cost classifications are the

Q68: Which type of compensation is most prevalent

Q88: What are Bleach's and Bleach-2's residual incomes,

Q88: Which of the following statements is TRUE

Q109: If sales increase by $25,000, operating income

Q150: Shirt Company wants to purchase a new

Q183: The primary advantage of the internal rate

Q186: What is the amount of finished goods