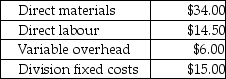

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

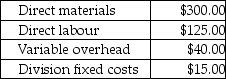

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division.The Compressor Division's operating income is

Definitions:

Hepatic Portal Vein

A large vein that carries nutrient-rich blood from the digestive organs to the liver for processing.

Inferior Mesenteric Vein

A vein that drains blood from the lower part of the large intestine and rectum into the portal venous system.

Inferior Phrenic Vein

A vein draining the diaphragm, usually flowing into the inferior vena cava or the superior suprarenal vein.

Superior Mesenteric Vein

A large vein in the abdomen that drains blood from the small intestine, part of the large intestine, and other organs in the digestive system into the portal vein.

Q2: Full-cost transfer pricing may be used because

Q8: ABC Grocery needs to know the kilograms

Q14: Imputed costs are costs recognized in particular

Q29: Bob Cellular Phone uses ROI to measure

Q44: Service-sector companies provide services or intangible products

Q107: In a job-costing system, explain why it

Q114: Computer integrated technology may increase workers' knowledge

Q116: Rozman Construction Supplies Ltd.is preparing the budget

Q140: The internal rate of return method may

Q201: An actual cost is a predicted cost.