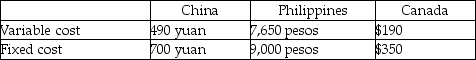

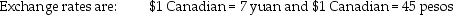

Hendricks Ltd.of Calgary manufactures and sells computers.The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines.The balance of the product is sold in the local market at 2,100 yuan/unit.The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit, with the balance shipped to Calgary.The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.The following budget data are available:

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada.Income taxes are not included in the calculation of cost-based transfer prices.Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions.Take each calculation to 2 decimal places.Required:

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada.Income taxes are not included in the calculation of cost-based transfer prices.Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions.Take each calculation to 2 decimal places.Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation.Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Definitions:

Personality

The combination of characteristics or qualities that form an individual's distinctive character and behavioral patterns.

Schizophrenic

Relating to schizophrenia, a severe mental disorder characterized by distortions in thinking, perception, emotions, language, sense of self, and behavior.

Dissociative Disorder

Dissociative Disorder refers to a spectrum of mental disorders characterized by disconnection and lack of continuity between thoughts, memories, surroundings, actions, and identity.

Fugue

A psychological state or condition in which a person loses awareness of their identity or other important autobiographical information and may engage in unexpected travel or wanderings.

Q4: Which of the following is NOT a

Q20: The Holiday Card Company, a producer of

Q21: What is the transfer price per litre

Q37: Some companies use dual pricing, using two

Q52: Sonora Manufacturing Inc.designs and builds off-road vehicles.The

Q158: The Auto Division of Fran Corporation has

Q162: National Can Company has three divisions, Eastern,

Q172: A Company wants to buy a moulding

Q181: The Cumberland Paint Company has two divisions.The

Q196: What is Montreal's cost of goods manufactured