Use the information below to answer the following question(s) .Hawkeye Cleaners has been considering the purchase of an industrial dry-cleaning machine.The existing machine is operable for three more years and will have a zero disposal price.If the machine is disposed of now, it may be sold for $30,000.The new machine will cost $200,000, an additional cash investment in working capital of $60,000 will be required and will be returned at the end of the project.The machine is expected to last 3 years and has an estimated disposal value at that time of $20,000.The new machine will reduce the average amount of time required to wash clothing and will decrease labour costs.The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $150,000 each additional year of use.These cash flows will generally occur throughout the year and are recognized at the end of each year.Income taxes are not considered in this problem.

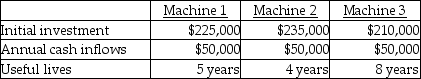

-Use the following information to determine which machines to purchase based on net present value.  Cost of capital is 10 percent.

Cost of capital is 10 percent.

Definitions:

Casual Sex

Sexual activities occurring outside of committed romantic relationships, often characterized by a lack of emotional attachment or long-term commitment.

Friends With Benefits

A type of relationship between friends where they engage in sexual activities without committing to a romantic partnership.

Romantic Partners

Individuals engaged in a romantic relationship, characterized by emotional and often physical intimacy.

Predictors

Variables or factors that can be used to forecast or anticipate future events, trends, or behaviors.

Q55: A report that measures financial and nonfinancial

Q58: Outlay costs are defined as the maximum

Q87: A new machine will cost $720,000.It is

Q99: When 50,000 units are produced the fixed

Q109: Explain what transfer prices are, and what

Q111: Museum Corporation uses the investment centre concept

Q112: "Uncertainty" may be defined as<br>A)the possibility that

Q124: Shrinkage costs result from water damage to

Q126: What is the transfer price per pair

Q180: Costing systems that identify the cost of