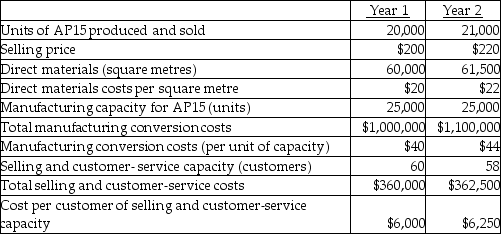

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Luke Company makes a high-end Appliance, AP15.Luke Company presents the following data for the years 1 and 2.  Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Luke Company's revenue effect of growth component?

Definitions:

Face Value

The nominal or original value of a security or financial instrument as stated by the issuer, crucial for calculating interest payments for bonds.

Real Return

The return on an investment after adjusting for inflation, representing the actual purchasing power gained or lost.

Inflation

The speed at which the total price for goods and services escalates, lessening the purchasing force.

Coupon

Represents the interest payment made to bondholders annually or semi-annually, expressed as a percentage of the bond's face value.

Q15: Maloney Corporation manufactures plastic water bottles.It plans

Q22: If a dual-rate cost-allocation method is used,

Q35: Which of the following does NOT represent

Q49: If a single-rate cost allocation method is

Q73: Krum Lawn Equipment has five departments, of

Q88: Your company produces 700,000 widgets per year

Q99: What is the paper's production approximate cost

Q104: Which of the following is NOT true

Q111: List the reasons that the sales value

Q114: What is the predicted indirect manufacturing labour