Use the information below to answer the following question(s) .N-C Associates is in the process of evaluating its new client services for the business consulting division.Estate Planning, a new service, incurred $600,000 in development costs and employee training.The direct costs of providing this service, which is all labour, averages $100 per hour.Other costs for this service are estimated at $2,000,000 per year.The current program for estate planning is expected to last for two years.At that time a new law will be in place which will require new operating guidelines for the tax consulting.Customer service expenses average $400 per client, with each job lasting an average of 400 hours.The current staff expects to bill 40,000 hours for each of the two years the program is in effect.Billing averages $140 per hour.

-Knowledge Transfer Associates is in the process of evaluating its new client services for the business systems consulting division.  What is the estimated life-cycle operating income for both years combined?

What is the estimated life-cycle operating income for both years combined?

Definitions:

Impairment Loss

A financial accounting concept that represents the reduction in the recoverable amount of an asset below its carrying amount.

Ownership Interest

The proportion of shares or rights in a company held by an investor, indicating the level of control and financial stake.

Equity Method

A financial accounting approach for recording investments, reflecting changes in the investment value based on the investor’s proportionate share in the investee’s net income or loss.

Voting Shares

Shares that grant the shareholder the right to vote on company matters, such as electing the board of directors.

Q4: Carl Clarkson and Lenny Lenid have been

Q13: Ski Vallet provides materials that let people

Q19: The incremental common cost allocation method requires

Q30: The growth component measures the increase in

Q37: Using the step-down method, what amount of

Q49: What is the Barry Company's revenue effect

Q78: Electronics Inc.has been unhappy with the financial

Q90: The growth component of a change in

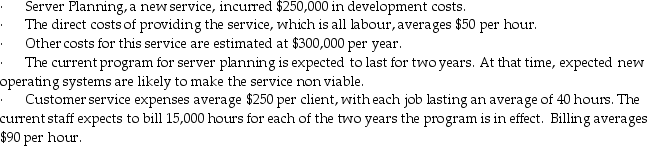

Q100: Compute the estimated costs for each of

Q226: An example of a nonfinancial balanced scorecard