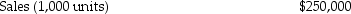

Hackerott Camera is considering eliminating Model AE1 from its camera line because of losses over the past quarter.The past three months of information for model AE1 is summarized below:

Manufacturing costs:

Manufacturing costs:

Support costs are 70% variable and the remaining 30% is depreciation of special equipment for model AE1 that has no resale value.Should Hackerott Camera eliminate Model AE1 from its product line? Why or why not?

Support costs are 70% variable and the remaining 30% is depreciation of special equipment for model AE1 that has no resale value.Should Hackerott Camera eliminate Model AE1 from its product line? Why or why not?

Definitions:

Fixed Cost

Costs that do not vary with the level of production or sales, remaining constant regardless of business activities.

High-Low Method

A technique used in cost accounting to estimate variable and fixed costs by analyzing the highest and lowest levels of activity and their associated costs.

Variable Cost

Variable costs are expenses that vary directly with the level of production or sales volume, such as raw materials and packaging.

Fixed Cost

Expenses that do not change in proportion to the level of goods or services produced by a business.

Q8: What are the four key perspectives in

Q9: Dumping is closely related to predatory pricing

Q15: The selection of the best measure of

Q17: The Waverly Company has budgeted sales for

Q47: What should be the cash disbursements during

Q53: The financial measures used to evaluate a

Q55: Lumberjack Inc.is a manufacturer of equipment for

Q105: The purpose of the balanced scorecard is

Q149: Ratzlaff Company has a current production level

Q171: Which of the following is an example