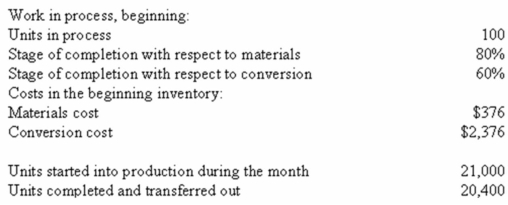

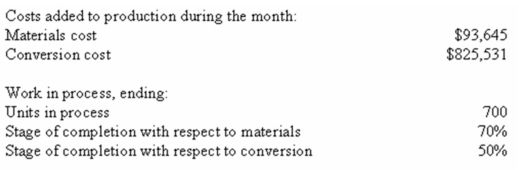

(Appendix 6A)Darver Inc.uses the FIFO method in its process costing system.The following data concern the operations of the company's first processing department for a recent month:

Required:

Prepare a production report for the department using the FIFO method.

Definitions:

Depreciation Rate

The percentage rate at which an asset is depreciated across its useful life, affecting the value of the asset on the balance sheet over time.

Straight-Line Method

A method of calculating depreciation by dividing the cost of an asset, minus its salvage value, by its useful life.

Residual Value

The estimated scrap or salvage value of an asset at the end of its useful life.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value of the asset over time due to use, wear, or obsolescence.

Q9: The most common accounting treatment of underapplied

Q17: A public accounting firm employs 10 full-time

Q31: The following information pertains to Malcolm Corporation

Q34: Assuming that Tru-Colour Paint Company uses the

Q64: Under variable costing,what was the unit product

Q80: What is the total period cost for

Q89: (Appendix 7A)Welk Manufacturing Corporation has a traditional

Q89: Under absorption costing,what was the unit product

Q109: The following data pertain to last month's

Q298: The contribution margin ratio always increases when