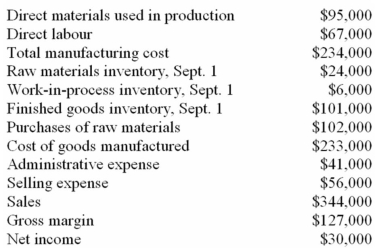

The following information is from Marchant Manufacturing Co.for September:

Required:

(a. )Compute the cost of goods sold.

(b. )Compute the balance in finished goods inventory at September 30.

(c. )Compute the balance in work-in-process inventory at September 30.

(d. )Compute the balance in raw materials inventory at September 30.

(e. )Compute the total manufacturing overhead.

(Hint: The easiest method of solving this problem is to sketch out the income statement and the schedule of cost of goods manufactured,enter the given amounts,and then enter the unknowns as plug figures. )

Definitions:

Stock

A type of security that signifies ownership in a corporation and represents a claim on part of the company's assets and earnings.

Fiscal Year-End

The last day of a company's accounting period, which is used for financial reporting and tax purposes, and can vary between organizations.

Automatic Extension

A provision allowing taxpayers to automatically extend their deadline for submitting tax returns or other required documents, without needing to provide a reason.

Return

A financial document summarizing an entity's income, deductions, and taxes owed over a specific period, often annually.

Q30: (Appendix 13A)The net present value of Project

Q33: Arget Company's net income last year was

Q34: Starrs Company has current assets of $300,000

Q52: Reddy Company has the following cost formulas

Q72: The times interest earned ratio of McHugh

Q105: To put the working capital figure into

Q165: (Appendix 13A)The net present value on this

Q170: Crawler Company's net income last year was

Q186: What is the expected dividend per common

Q215: What is the break-even point in annual