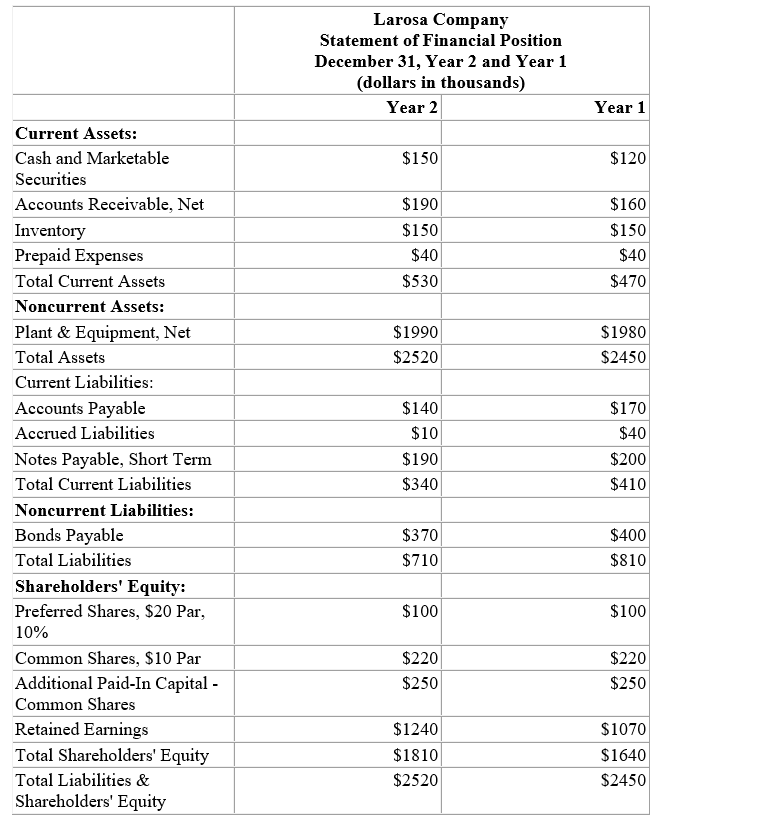

Financial statements for Larosa Company appear below:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31 , Year 2 was .

-Larosa Company's return on total assets for Year 2 was closest to which of the following?

Definitions:

Foster Child

A child placed by a government agency or a court in the care of someone other than their biological parents.

Vicarious Liability

A legal principle wherein one party is held liable for the actions of another party, often used in employer-employee relationships.

Legal Responsibility

The obligation to act in accordance with the law and be accountable for one's actions in a legal context.

Acts of Another

Legal principle referring to the actions of a person that can affect the legal rights or responsibilities of another person.

Q7: If the market value of a common

Q22: Which of the following is an example

Q32: If CD Company sells 50,000 units,what is

Q44: The following account balances have been provided

Q47: Prime cost consists of direct materials and

Q61: What is the book value per share

Q75: What is the net monetary advantage (disadvantage)of

Q87: The following data pertain to activity and

Q165: (Appendix 13A)The net present value on this

Q239: The following is last month's contribution format