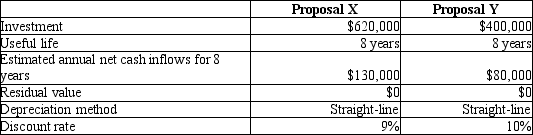

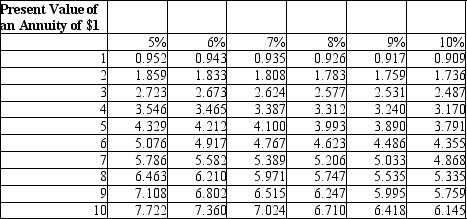

Simms Manufacturing is considering two alternative investment proposals with the following data:

After calculating the net present value of the two alternatives, Proposal Y appears to deliver the most

After calculating the net present value of the two alternatives, Proposal Y appears to deliver the most

favorable results.

Definitions:

Put Option

An agreement that grants the holder the option, without the requirement, to sell a predetermined quantity of a fundamental asset at an agreed-upon price during a defined period.

Forward Contracts

Customized contracts between two parties to buy or sell an asset at a specified price on a future date, used for hedging or speculation.

Futures Contracts

Agreements for the future delivery of assets like commodities or securities at a price fixed upon the contract's signing.

Option Contracts

Financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

Q18: Purchases for May were $100,000, while expected

Q27: Responsibility accounting performance reports are prepared by

Q32: Paula sells hand-knitted scarves at the flea

Q37: In a balanced scorecard system, which of

Q48: Fairfield Company management has budgeted the following

Q56: Assume that AAA Company's Payroll and Human

Q74: Orlando Avionics makes three types of radios

Q80: Carte Blanco Company is evaluating an investment

Q94: Standard cost is a budget for a

Q95: Becky's Bakery sells three large muffins for