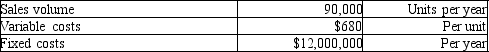

Maxi Production is a price-taker. They produce large spools of electrical wire in a highly competitive market, and so they practice target pricing. The current market price is $800 per unit. The company has $2,000,000 in assets and shareholders expect a return of 5% on assets. The company provides the following information:  Currently the cost structure is such that the company cannot achieve its profit objective and must cut costs. If fixed costs cannot be reduced, how much reduction in total variable costs will be needed to achieve the profit target?

Currently the cost structure is such that the company cannot achieve its profit objective and must cut costs. If fixed costs cannot be reduced, how much reduction in total variable costs will be needed to achieve the profit target?

Definitions:

Allowance Method

An approach in accounting that calculates expected losses from bad debts by assessing uncollectible accounts at the conclusion of each period.

Estimated Bad Debts

A provision in accounting for the amount of receivables that are expected not to be collected, considered an expense.

Accounts Receivable Turnover

A financial ratio indicating how many times a company's receivables are turned over during a period.

Specific Accounts

Refers to accounts designated for specific purposes or transactions, distinguishing them from general or combined accounts.

Q39: Alpine Productions uses a standard costing system

Q54: Jarvis Foods produces a gourmet condiment which

Q56: Which of the following correctly describes the

Q70: Nemesis Company manufactures water skis. Nemesis pursues

Q104: Juan Martinez played classical guitar professionally until

Q109: Which of the following statements is FALSE?<br>A)Many

Q127: Orleans Company has a normal range of

Q128: Which of the following statements is TRUE

Q145: Which of the following describes the sales

Q152: If you invest $3,000 today at 7%