Art Parrish, the sole employee of Parrish Sales, has gross salary for March of $4,000. The entire amount is under the OASDI limit of $106,800, and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. Art has a deduction of $320 for health insurance and $80 for United Way. Please provide the second entry in the payroll cycle to record the disbursement of his net pay.

Definitions:

Q4: Which of the following is an example

Q50: The director of graduate admissions is analyzing

Q77: Suppose that 60% of the students do

Q109: An analyst expects that 10% of all

Q118: Art Parrish, the sole employee of Parrish

Q126: Which of the following accounts increases with

Q142: Professors at a local university earn an

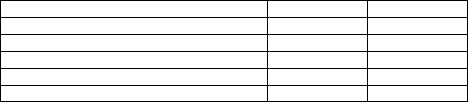

Q146: The table below gives the deviations of

Q148: The following are the ending month's balances

Q154: Which of the following concepts (or principles)require