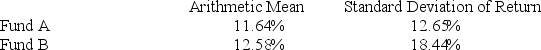

The following table summarizes selected statistics for two portfolios for a 10-year period. Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

Definitions:

Infinite Recursion

A situation in which a function or method calls itself without an exit condition, leading to a stack overflow error.

Base Case

In recursive programming, a condition that stops the recursion by not making any further calls.

Recursive Methods

Functions or methods in programming that solve problems by calling themselves with modified arguments, often with a base case to end the recursion.

Stopping Case

A condition used to terminate a recursive function, preventing it from running indefinitely.

Q42: A bar chart may be displayed horizontally.

Q48: Each financial statement includes a heading giving

Q49: Which of the following scales represents the

Q52: The variance of a random variable X

Q59: Which of the following is a major

Q64: Let X be normally distributed with mean

Q84: A population consists of<br>A) all items of

Q101: In a marketing class of 60 students,

Q143: Romi, a production manager, is trying to

Q150: Which of the following are NOT required