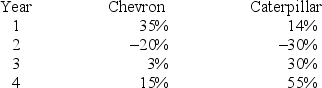

The following table shows the annual returns (in percent) Chevron and Caterpillar for  .

.  (See the Excel Data File.)

(See the Excel Data File.)

A) Which fund had the higher arithmetic average return?

B) Which fund was riskier over this time period?

C) Given a risk-free rate of 1%, which fund has the higher Sharpe ratio? What does this imply?

Definitions:

Current Liabilities

Financial obligations a company is expected to settle within one year or within its operating cycle, whichever is longer.

Current Ratio

A financial metric that measures a company's ability to pay off its short-term liabilities with short-term assets.

Total Asset Turnover

A financial ratio that measures a company's efficiency in using its assets to generate sales revenue, calculated by dividing sales revenue by total assets.

Noncurrent Assets

Assets not expected to be converted into cash within one year or the operating cycle, including property, plant, and equipment.

Q7: According to geologists, the San Francisco Bay

Q32: In each of the following statements, determine

Q39: A soft drink company fills two-liter bottles

Q73: The odds against winning $1.00 in the

Q83: An analyst believes the probability that U.S.

Q86: The following table summarizes the ages of

Q91: When some objects are randomly selected, which

Q105: The dividend yields of the stocks in

Q131: Amounts spent by a sample of 200

Q140: What is probability?<br>A) Any value between 0