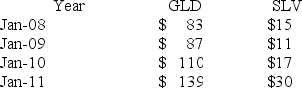

The Yearly Prices (rounded to the nearest dollar) for GLD (a gold exchange traded fund) and SLV (a silver exchange traded fund) are reported in the following table.  (See the Excel Data File.)

(See the Excel Data File.)

A) Calculate the sample variance and sample standard deviation for the GLD ETF and SLV ETF.

B) Which asset had a greater variance?

C) Which asset had the greater relative dispersion?

Definitions:

Hypnotist

A person skilled in hypnosis, the practice of inducing a state of heightened focus, reduced peripheral awareness, and increased suggestibility.

Transcendental Meditation

A technique for detaching oneself from anxiety and promoting harmony and self-realization by meditation, repetition of a mantra, and other yogic practices.

Fatty Acid

A long chain of hydrocarbon derived from the breakdown of fats, important in diet and metabolism.

Cholesterol

A waxy, fat-like substance found in all the cells of the body, involved in the synthesis of vitamin D, some hormones, and bile acids for digestion, but high levels may lead to heart disease.

Q8: Consider the following cumulative distribution function for

Q11: Body weight is an example of a

Q12: When summarizing quantitative data it is always

Q27: Bayes' theorem uses the total probability rule

Q29: Let P(A) = 0.4, P(B|A) = 0.5,

Q30: Scatterplot is a graphical tool that is

Q35: A consumer who is risk neutral is

Q66: FUTA (federal unemployment compensation)tax is paid by

Q89: An investor bought common stock of Blackstone

Q115: An auto parts chain asked customers to